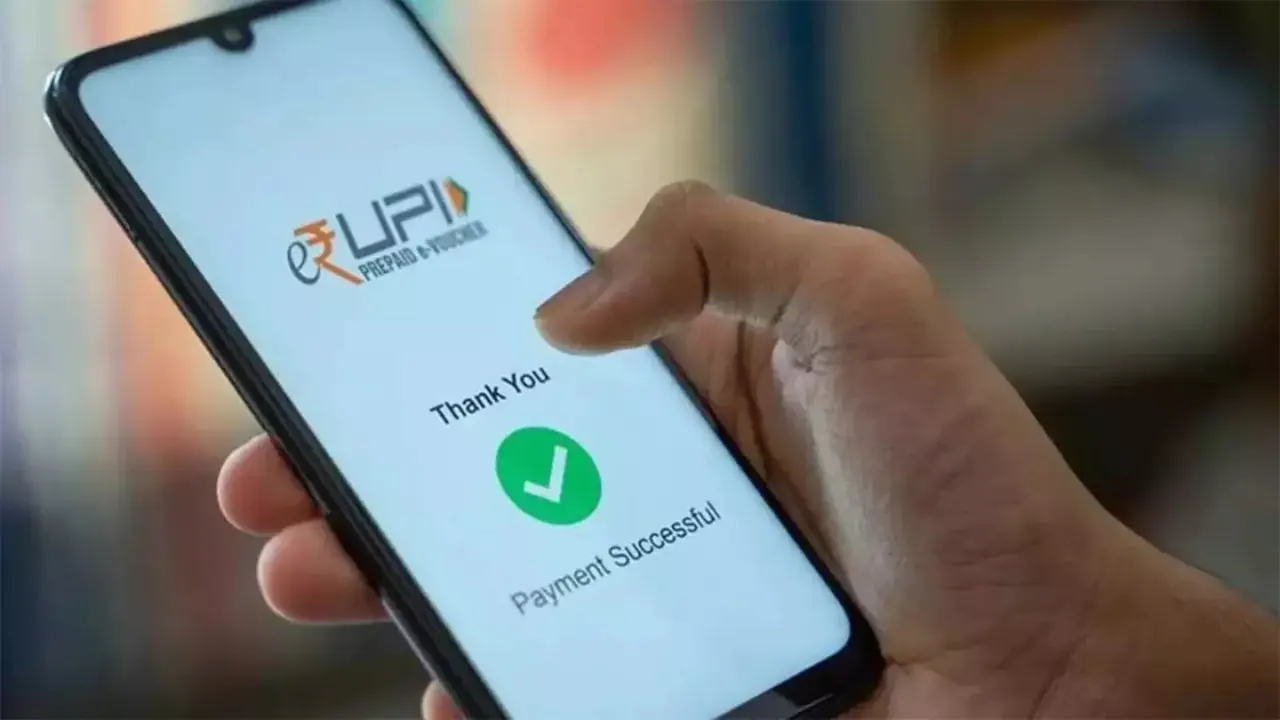

In India, on March 26, 2025, Unified Payments Interface (UPI) services faced serious issues, impacting many users and leading to the failure of online applications.

Subsequently, this includes popular UPI-enabled service providers Google Pay, Paytm, PhonePe, and BHIM.

The interrupted services caused inconveniences for many consumers and businesses who leverage applications to conduct digital transactions.

Scope of the Trouble

Based on DownDetector, a website that tracks the failure of an online service, there were roughly 2,750 complaints regarding UPI failures as of 7:50 PM the same day. Of these, 296 were from users of Google Pay, while 119 were from Paytm.

Additionally, 376 users were impacted within the State Bank of India (SBI) application. The majority of complaints pertained to the transfer of funds and online banking services.

Effects on Major Banks

The service interruption affected several major banks’ ability to allow users to conduct their transactions digitally. SBI, India’s largest public sector bank, experienced significant difficulties with UPI services.

Likewise, many SBI users had issues with funds transfer or online banking services. Similarly, HDFC Bank, Bank of Baroda, Bank of Maharashtra, and Kotak Mahindra Bank reported outages with their UPI applications. Therefore, their customers’ transactions were disrupted.

Experiences and Responses from Users

Many users posted on social media about their frustrations and the lack of information about the outage. Reports revealed that people could not make payments for essential goods and services.

Consequently, this illustrates that people depend on UPI to handle daily transactions. Similarly, businesses reliant on digital payments also reported interruptions from the outages.

Response and Recovery Actions

In response to the interruptions, banks and payment service providers worked hard to identify and address the root cause. HDFC described the outage and advised that it had been corrected, which allowed users to process payments without errors.

Similarly, SBI described the technical issues they were experiencing and assured customers that actions had been taken and services had resumed. The National Payments Corporation of India (NPCI) worked with banks to repair the outages and bring services back online.

Prior Incidents of Outages

This occurrence is not an isolated event, as there have been several instances of UPI service disruption across several banks and payment services. In February 2024, UPI transactions saw a drop due to fewer days in the month. Surprisingly, it totaled 1,210 crores in financial transfers for ₹18.28 lakh crore.

Furthermore, in April 2023, SBI services such as UPI and internet banking, were down for approximately three hours during annual close-out activities. These events highlight the necessity of adequate technological infrastructure.

Additionally, the contingency plans to minimize disruptions. This UPI outage on March 26, 2025, also emphasizes the importance of digital payment systems in India’s financial ecosystem. The efficient response from the banks and NPCI helped restore UPI service promptly.

Still, the event highlights the importance of continued monitoring and improvement of digital payment infrastructure to prevent future outages. As a matter of fact, for consumer use, trust, and reliance on payment systems such as UPI increases, it is essential to ensure uptime and resiliency in the system.