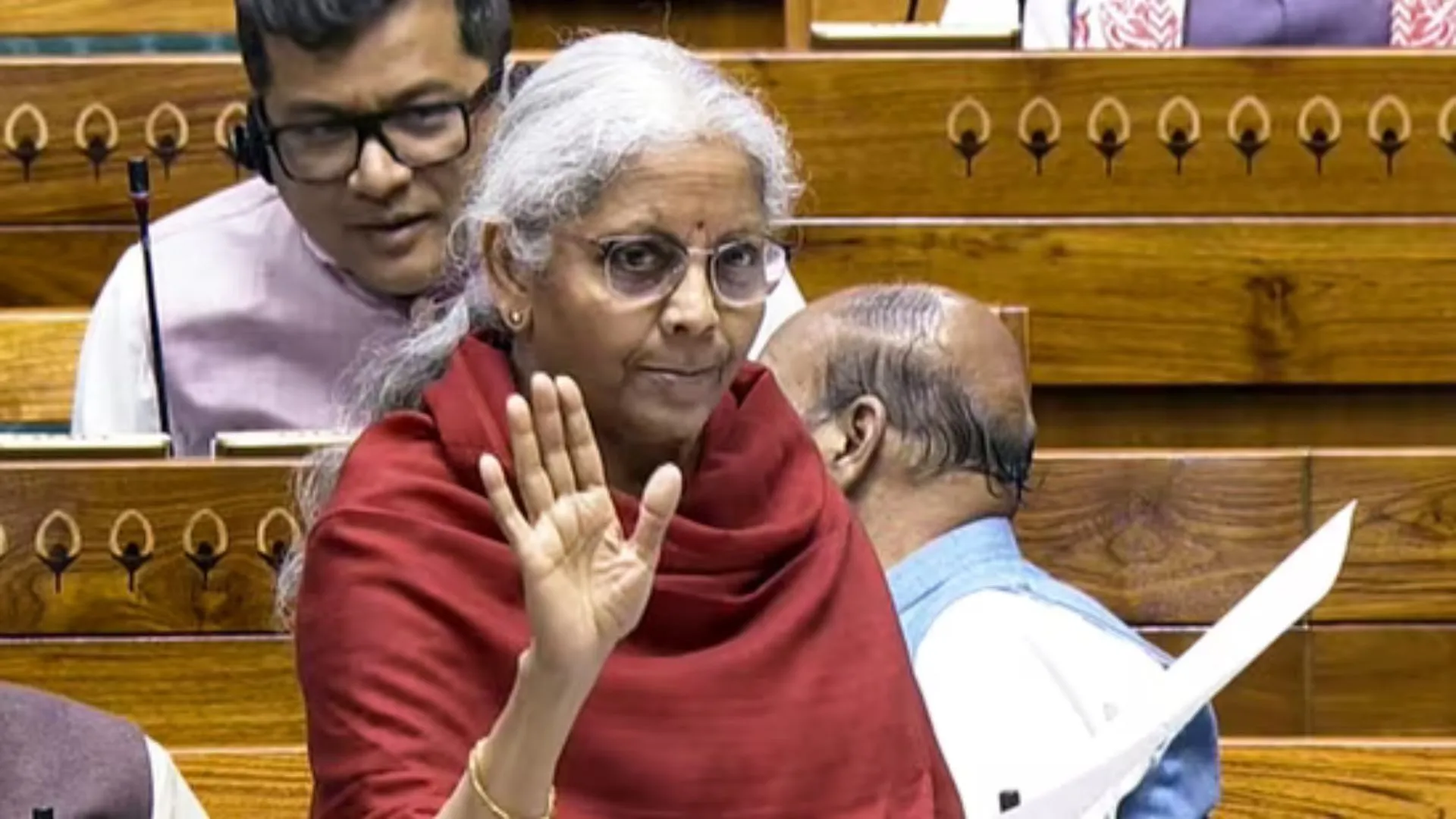

Today, in a major step to reform India’s tax regime, Finance Minister Nirmala Sitharaman introduced the Income Tax Bill 2025 in the Lok Sabha. The proposed legislation aims to simplify existing law and make it accessible and understandable for taxpayers.

The session saw considerable ruckus as some members of the opposition staged a walkout to protest against this focus on regime reform.

Goals for the New Income Tax Bill

The Income Tax Bill 2025 seeks to replace the Income Tax Act of 1961, which over the years became extremely complex because of the number of amendments. The new bill seeks to achieve the following objectives:

- Simplification of Tax Laws: By reducing the number of sections under dispute from 819 to 536, this bill sets forth a simplified and user-friendly law.

- Clarity and Transparency: The bill calls for the elimination of archaic provisions and a presentation of tax rates in a tabulated format, thus reducing ambiguities and potential litigation.

- Encouragement to Voluntary Compliance: Clear provisions hopefully will help inculcate a spirit of voluntary tax compliance among the citizens.

What the Government Said

While introducing the bill, Finance Minister Sitharaman made a case for updating the tax regime to reflect the modern economic reality. She added that the existing Income Tax Act had to go through approximately 4,000 amendments ever since its inception and it had increased complexity, leading to litigation.

The new bill comes to resolve these by streamlining provisions and removing redundant ones.

Addressing this, Sitharaman said: “The Income Tax Act was originally enacted in 1961 and came into force in 1962. At the time, it only had 298 sections. In the course of time, so many sections were added that presently it has 819 sections. We are going to bring it down from 819 to 536.”

The Walk Route of Opposition in Parliament

Immediate resistance was met from the opposition with the introduction of the Bill. MP NK Premachandran from Kollam said that the architecture of the bill is concerning, arguing that it has more sections than the original 1961 Act. In reply, Sitharaman maintained that, though the current bill is broad in scope, it is sought as an improvement over the current sequence of 819 sections to 536 for simplification purposes.

Not satisfied, however, still waved a banner of dissent among the opposition. The TMC MP Professor Sougata Ray burnt down any mechanical tunes of the bill as pennies without sound and substance.

In the end, a good number of opposition legislators walked out in protest against the provisions of the bill and its manner of introduction.

Further Steps: Referred into the Committee on the Select House

In order to deepen consideration of the bill, Finance Minister Sitharaman has proposed that the Income Tax Bill 2025 be referred to the newly constituted Select House Committee.

The terms and conditions pertaining to this committee would be decided by the honorable Speaker, Om Birla. The committee should submit its report on the first day of the next parliamentary session, which will allow further debate on possible amendments based on its recommendations.

Implications for the Taxpayer

With the Income Tax Bill 2025, once passed, may have a few predictable and obvious effects for taxpayers:

- Ease of Compliance: Simplified language and clearer provisions are expected to ease the process for individuals and businesses in understanding and complying with tax obligations.

- Fewer Conflicts: By removing ambiguities and outdated provisions, the bill seeks to reduce the volume of inconsistencies and legal challenges concerning taxation.

- Openness of Procedures: Adoption of tabulated tax rates and elimination of tortuous clauses will allow tax computations and exposure to be much more open to scrutiny.

With the introduction of the Income Tax Bill 2025, India takes a bold step in its reform measures to its taxation. The government’s intention of bringing together simpler and easier tax regimes and the apprehensions by the opposition raise the need for deeper deliberation.

The various players concerned are expected to watch with a hawk on the processes since, when enacted, the bill can prove to be a backbreaker for the nation’s economy.